BEST-IN-CLASS Capabilities

Tokenized Payments

Reduce fraud, gain share of wallet and meet consumer demand for simpler, more secure digital payments with a complete solution for tokenized payments from Fiserv.

KEY FEATURES

Technology to simplify and secure payments

01

Issuers can participate in tokenization without making system changes.

02

Account/core processors can continue to use existing card and transaction processing logic.

03

Reduce the risk of fraud in digital channels and enhance transaction security.

04

Automate processes to meet all compliance and card association requirements.

05

Improve cardholder satisfaction with a simple, secure solution that keeps cards in their hands.

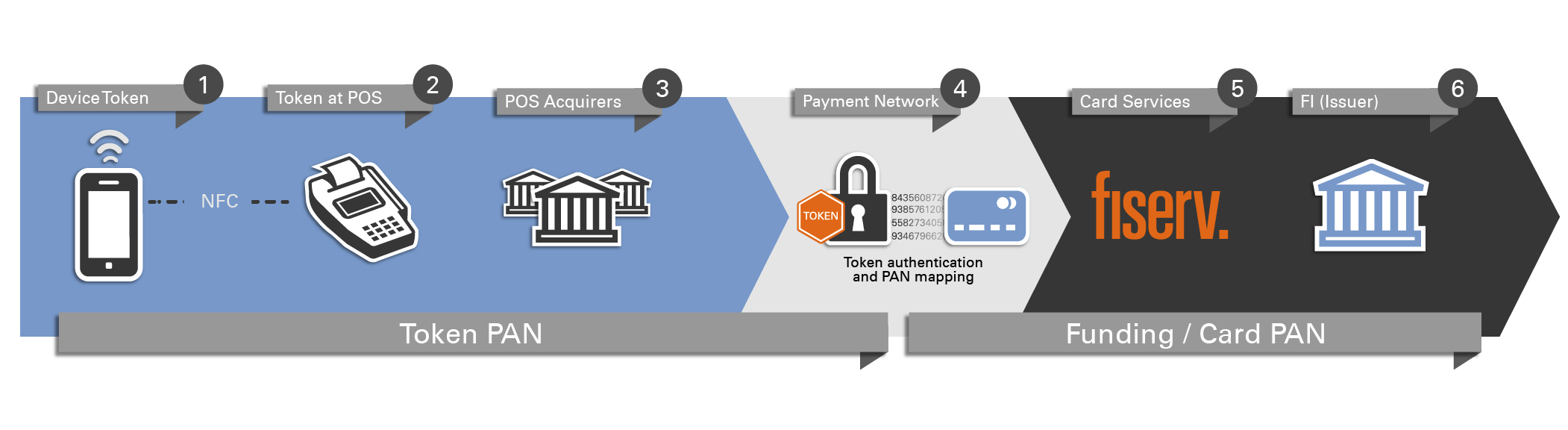

How tokenization works

Tokenization is the process of replacing the traditional payment card Primary Account Number (PAN) with a unique numeric digital token in transactions.

Discover insights related to tokenization