How Modern Cores Support Strategic Goals for Banks and Credit Unions

A digitally focused core platform enables financial institutions to make strategic moves that expand their base, increase deposits and drive adoption of their products.

The way financial institutions show up digitally has evolved dramatically in recent years. Core banking operations are moving from legacy systems that process transactions, enable loan decisions and open accounts in silos to interconnected ecosystems that revolve around consumer needs and deliver more personalized self-service that’s consistent across channels.

A modernized core system can help financial institutions enhance their market appeal by:

- Onboarding new consumers and businesses seamlessly

- Providing faster loan decisions

- Tailoring products to meet the specific needs of their market

- Enabling real-time payments and deposits

Built for reliability as well as flexibility, Fiserv core platforms not only meet pressing technological needs today but also offer the flexibility to adapt to shifting demands in the future. Here are four ways they enable financial institutions to accomplish their strategic goals:

Broadening the base by investing in digital offerings

Expanding into a new market – whether it’s a geographic area or a niche segment – can be costly. On average, traditional banks and credit unions pay hundreds of dollars to acquire a new customer or member. However, the cost can be more than 70 percent lower for a digitally acquired customer or member. That savings comes from investing in digital products and services, rather than outsized investment in brick- and-mortar retail locations that come with significant overhead costs.

Digitally acquired consumers

cost 70% less

than traditional consumers

“The landscape of how people make financial transactions is changing, and that’s what is driving financial institutions to be as competitive as possible in providing not only digital products, but also interactive teller machines (ITMs) and branches,” said Dudley White, President of Core Account Processing Solutions at Fiserv. Financial institutions “must have a core platform that can support all of those channels.”

To enable the modern digital banking products that attract new customers and members at a fraction of the cost – including real-time payments, online loan origination and onboarding new accounts – institutions need an open and flexible core ecosystem. With Fiserv, banks and credit unions get the infrastructure required to be agile and adopt innovative digital tools that help them stay ahead of competitors and offer an unmatched user experience.

Tapping into analytics to identify cross-selling opportunities

Today’s consumers want a hyper-personalized experience, meaning they expect financial institutions to offer products truly designed to meet their unique needs – where and when they need them. Leveraging a modern core ecosystem, banks and credit unions can use analytical tools to review an individual’s data and spending habits, then identify opportunities to cross-sell products or offer solutions that fit their current needs.

Fiserv has the hard data, a suite of insights and analytics tools, plus a team of advisors to help financial institutions supercharge their growth.

Advisors work one-on-one with banks and credit unions to ensure they are fully leveraging the data at their fingertips, identify areas of opportunity and recommend proven solutions designed to deliver best- in-class results.

“We know that we have more data than anyone in our space and the analytical expertise to identify courses of action based on that data,” White said. “And while the quantity of data we have allows us to gather unique insights, we are now moving away from just supplying data to offering real and unique insights that we can tell clients, ‘Here’s what the data is telling us and here are the recommendations to help you accomplish your strategy.’”

Attracting younger consumers by offering real-time everything

The earning, spending and investing potential of Gen Zers and millennials continues to grow. These young consumers now make up more than half of the total U.S. workforce, and they are looking for a place to put their hard-earned money.

When it comes to making financial decisions, Gen Z and millennials expect a fast-paced digital environment that adapts to their needs.

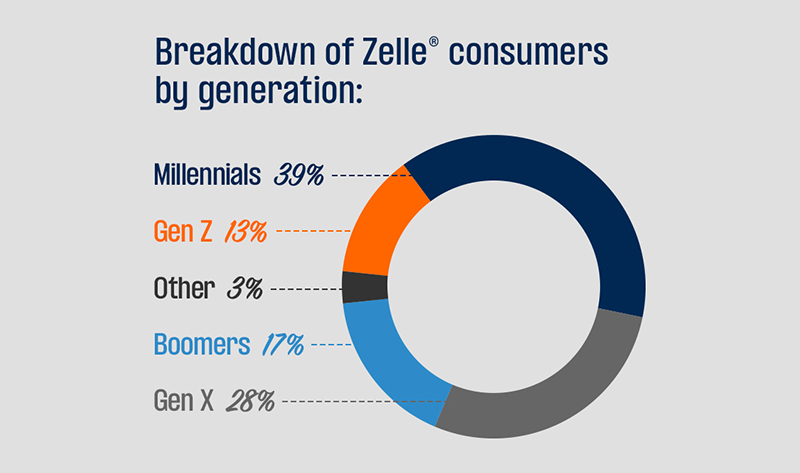

That means payments must happen in real time – no two-business-day delays. It’s no wonder that these generations make up more than half of all Zelle users.

A modern core ecosystem enables real-time person-to-person and loan payments, matching the speed these users expect from the apps they use each day. “From a Fiserv perspective, we’re on a journey of real-time everything,” White said. “With our new core, CoreAdvance, we already have real-time loan processing capabilities, and real-time deposits and exception management are coming next. Many of our account processing cores already offer real-time deposits today, and financial institutions are seeing the difference real-time makes.”

Adding commercial and small business services

Financial institutions can diversify their base by appealing to businesses, a strategy that offers major growth potential – small business banking makes an estimated $150 billion in annual revenue for the American finance industry.

Banks and credit unions that use a Fiserv account processing solution to support business banking have expanded significantly. Dime Community Bank, a $14-billion bank in the New York tri-state area, switched to a core platform from Fiserv in 2017 to support its expansion into commercial banking, and the bank continues to grow both organically and through M&A. “We have grown our deposit base by almost $2 billion on the commercial side over the last 18 months, in large part to the relationship we have with Fiserv and the products we use,” said Michael Fegan, SEVP, Chief Technology and Operations Officer. “Our business customers use our products because they’re best in class, they are reliable, and they work. We have the best commercial core platform out there.”

Core Modernization

Discover four ways core banking technology is shaping the future of financial services.