Four Advantages of Mobile Check Deposit With Expedited Funds Availability

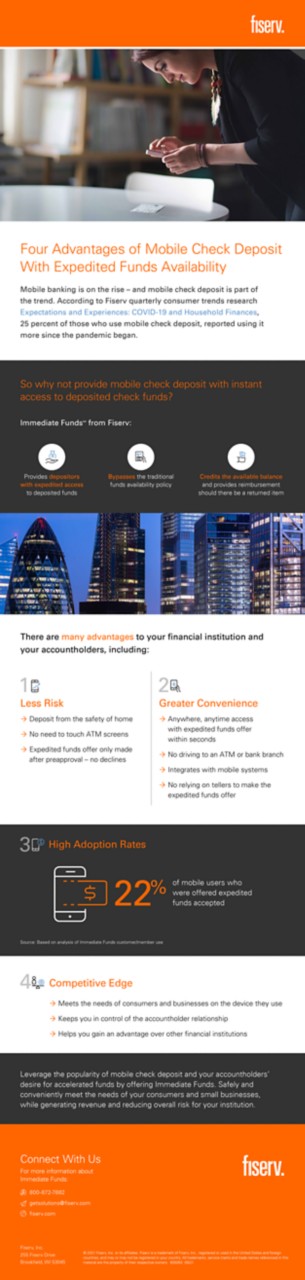

Mobile banking is on the rise – and mobile check deposit is part of the trend. According to Fiserv quarterly consumer trends research Expectations and Experiences: COVID-19 and Household Finances, 25 percent of those who use mobile check deposit, reported using it more since the pandemic began.

By providing mobile check deposit with instant access to deposited check funds, your financial institution can safely and conveniently meet the needs of your consumers and small businesses while generating revenue and reducing overall risk for your institution.

Download our infographic to learn about the advantages to your financial institution and your accountholders, including:

- Reduced risk

- Greater convenience

- Higher adoption rates

- Competitive edge

Immediate Funds

Leverage the popularity of mobile check deposit and your accountholders’ desire for accelerated funds by offering Immediate FundsSM from Fiserv. The solution provides depositors with expedited access to deposited funds, bypasses the traditional funds availability policy, and credits the available balance, providing reimbursement should there be a returned item.

Have a question for us?

For more information on Immediate Funds, complete the short form below.