How digital card issuance drives digital engagement

For issuers, moving their cards to the top of digital wallets is a key first step

Many financial institutions and card issuers are racing to raise the level of digital engagement with their cardholders. It’s easy to see why. In financial services, as in just about every other industry, consumers are increasingly digitally savvy. They expect an always-improving experience that meets their ever-changing needs.

Consider the growth in consumer debit- and credit-card usage. The number of open credit card accounts grew from 401.5 million in 2014 to 572.9 million in 2022, according to Javelin Strategy & Research. As for debit, Mercator Advisory Group estimates the value of purchases made on Mastercard and Visa debit cards will increase by 12% from 2022 to 2023.

What’s powering this growth in card usage? At least in part, the answer lies in the many new ways in which cardholders are using their cards. Examples include:

- Online spending, which has evolved to include curbside pickup and online ordering with in-store returns

- Recurring charges for ongoing services, which run the gamut from streaming services to connected fitness and credit monitoring

- Card-on-file stored payments, which enable faster checkout for food delivery, ride sharing and retail chains both online and brick and mortar

- Digital wallets, which enable consumers to pay in person quickly and contact-free with their phones

As consumers adopt new uses for card-based spending, issuers want cardholders to use their cards. Digital issuance is an opportunity for issuers to meet customer expectations and remain relevant to younger and tech-savvy consumers.

Digitize the first touch with cardholders

Issuers can generate long-term revenue from the many new types of digital consumer spending. To support these use cases, card issuers need a strategy to get their cards to the top of their cardholders’ digital wallets.

Digital issuance of new and reissued cards is a logical and effective first step in this strategy.

Digital issuance provides the cardholder with a digital version of a preactivated new or reissued card for immediate use in digital wallets and online shopping. It meets consumer demand by ending the inconvenience of waiting for a physical card while also preventing lost transactions for the issuer.

Credit and Debit Card Digital Issuance from Fiserv

With Digital Issuance from Fiserv, financial institutions and card issuers can provide their cardholders with immediate contactless capabilities. Create an exceptional digital experience that solidifies brand loyalty and helps to generate long-term transaction revenue by promoting top-of-wallet credit- and debit-card usage.

With Digital Issuance, once cardholders receive their digital cards, they can start using them immediately – resulting in earlier transactions not possible before. And when cardholders use a card right away, the issuer’s brand can elevate to top of mind for spend, even after the plastic card arrives.

Digital Issuance is part of CardHub from Fiserv, which is a next-generation digital experience that helps financial institutions drive card acquisition, usage and growth through a single, unified platform. Read this interview with Jeri Scheel in Bank Automation News for more about Digital Issuance from Fiserv.

How digital issuance works

Digital issuance is a must-have for lost or stolen card reissuing, removing the cardholder’s immediate anxiety. But digital issuance is also an effective new account opening tool, especially if the issuer doesn’t issue plastic on premises or if the new account was opened online or over the phone.

As soon as the new or reissued card record enters the issuer’s processing environment, the cardholder receives a text message alerting them to the availability of their new digital card.

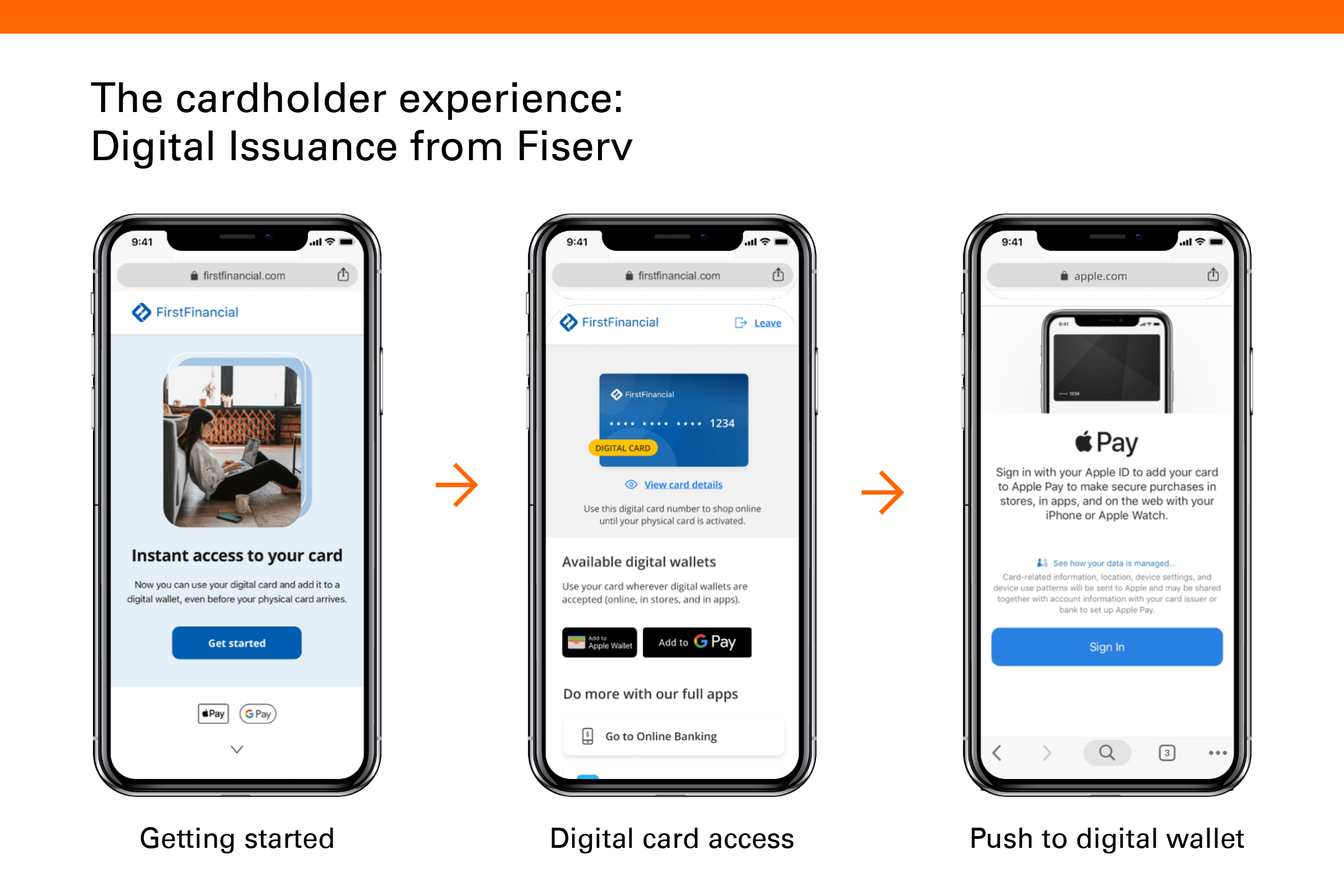

After clicking the link to a webpage in the text message, the cardholder is taken to a “Getting Started” page. Next, the cardholder verifies their identity by, for example, entering the last four digits of their Social Security number. Then, the user receives an authentication token by email to confirm their identity and agree to the card issuer’s terms and conditions.

The cardholder is then taken to a webpage that gives access to the digital card. There are three key functions on this webpage:

- View card details: The cardholder accesses a digital card with the three elements needed to use the card immediately online or in a mobile wallet: the primary account number (PAN), a temporary CVV and a temporary expiration date. (In the case of reissued cards, cardholders receive a new PAN.)

- Available digital wallets: The cardholder can quickly and easily push the card into available digital wallets (most often Apple Wallet® and Google Pay®) and make that card the new default payment method. That’s because digital issuance prepopulates the card details within the digital wallet. Digital Issuance from Fiserv also eliminates the need for additional verification of the cardholder’s identity (that is, the dreaded yellow-path provisioning process). Since the new card is being added to the digital wallet directly from the issuer’s processing environment, no added back-end verification is needed.

- Activate the issuer’s online banking apps: Raising a cardholder’s digital engagement is an important benefit of digital issuance. On this webpage, cardholders are prompted to access the issuer’s full suite of online banking services. For new cardholders, since the relationship is beginning with digital issuance, it’s the ideal place to make the first request to the cardholder to enroll in online banking. For reissued cards, it’s an opportunity to attract existing cardholders to online banking.

Taking back the competitive advantage

Digital issuance gives financial institutions and issuers the platform they need to compete against incumbents as well as new offerings.

The Apple Card® is an instructive example of this new breed of card offering. Although Apple cardholders receive a physical card, the digital experience is central to this product. For example, the card is provisioned directly to the cardholder’s Apple Wallet as part of the setup process. Digital Issuance from Fiserv can be an effective response to such competitive threats.

In the final analysis, digital issuance is of strategic importance because it helps support top-of-wallet status and promote increased transaction activity. This may result in higher issuer interchange, greater reliance on the issuer’s card and more loyalty to the issuer’s brand. And for younger consumers, who expect a totally online experience, digital issuance helps satisfy this key demographic.

Discover insights related to digital card issuance