The Fintech Imperative for Financial Institutions

Why delivering next-generation fintech experiences is essential for banks and credit unions

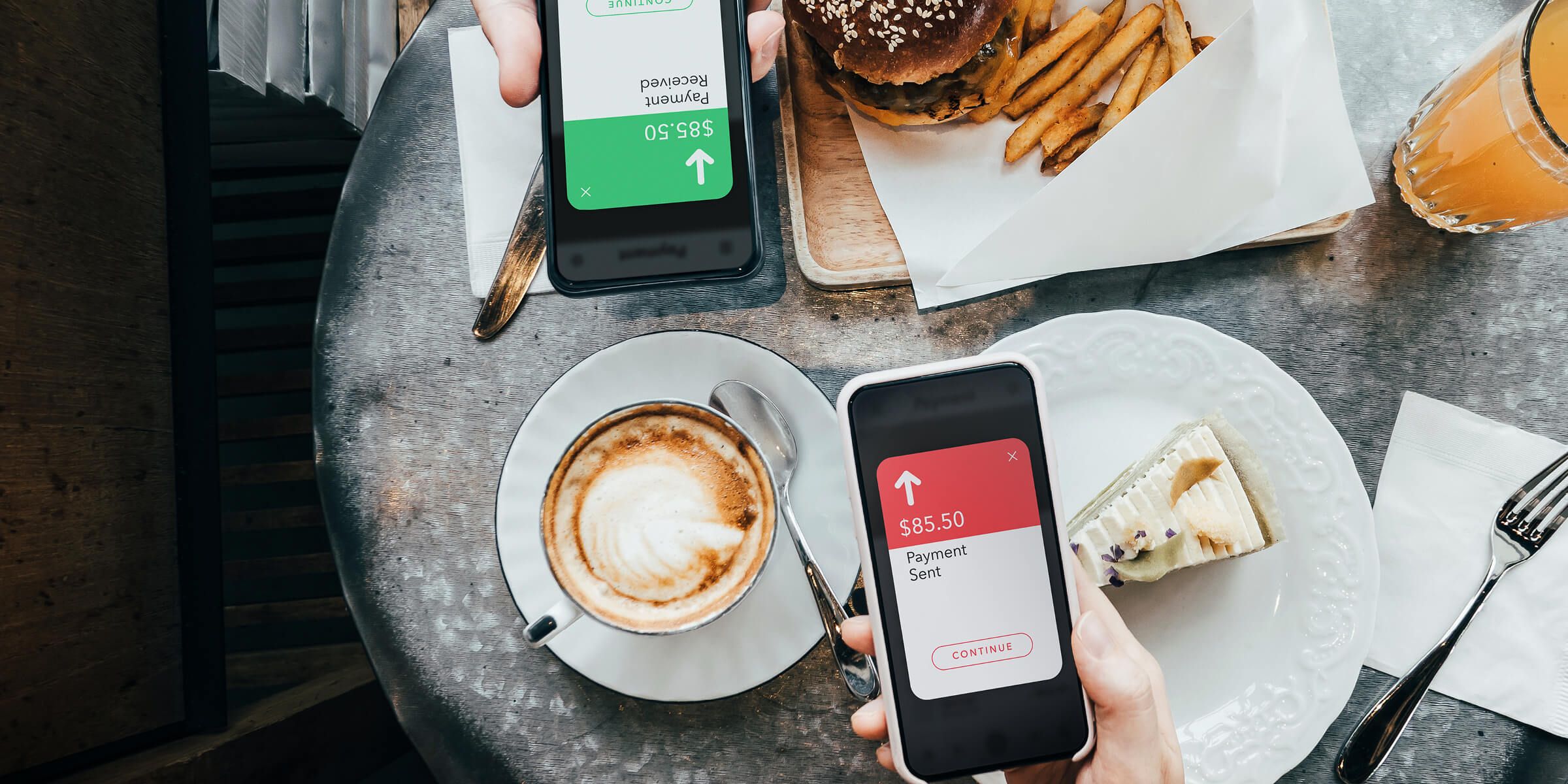

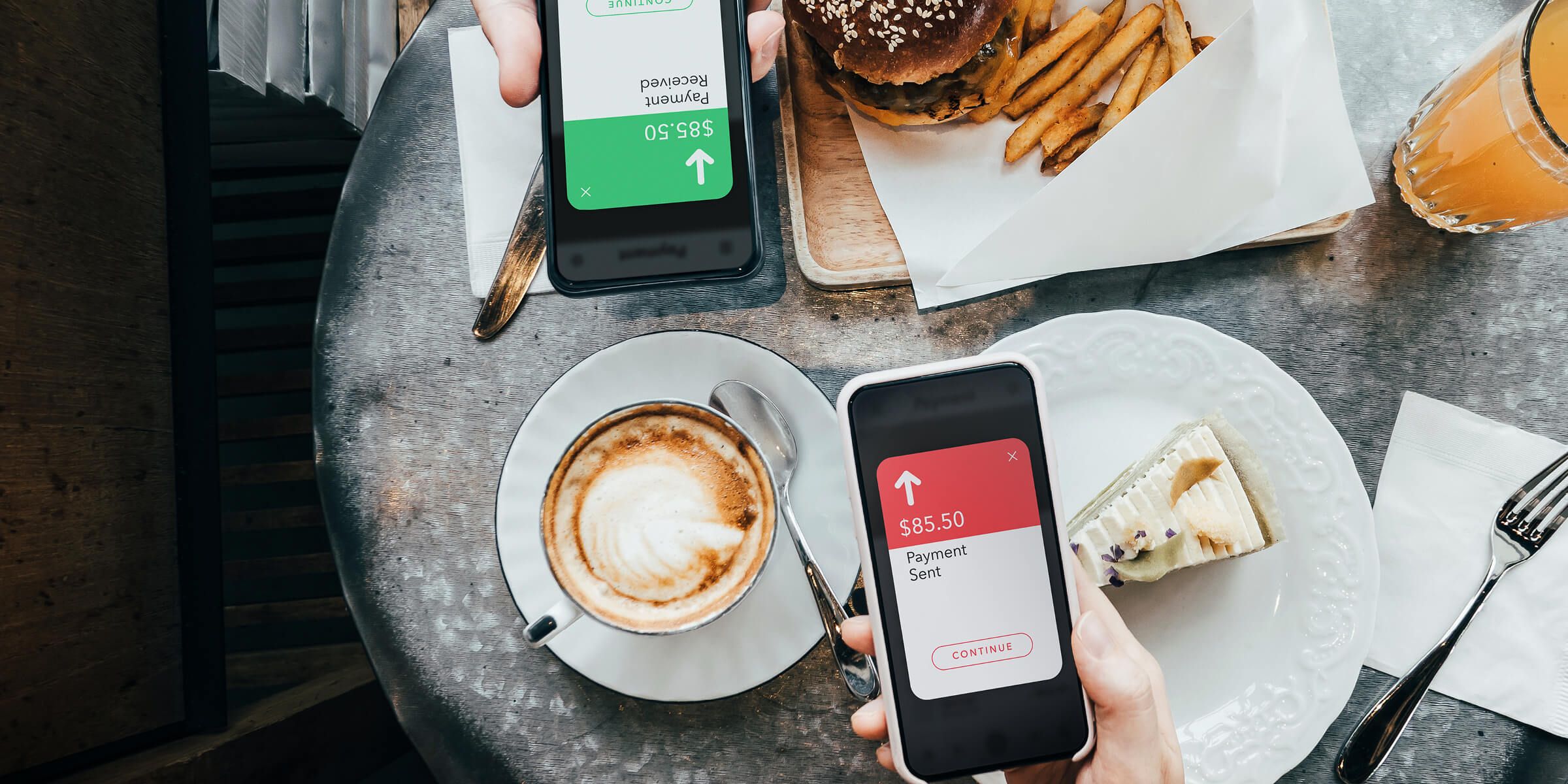

The pandemic accelerated digital engagement across every industry but nowhere are the shifts as pronounced as in financial services.

To succeed in a changing market, financial institutions are rethinking their digital strategies. Many are using fintech partnerships to launch new services that appeal to the next generation and enable user journeys that prioritize the consumer experience instead of the banking or payment transaction.

Leveraging Fintechs to Enhance the Digital Experience

Some financial institutions partner directly with fintechs, which leverage APIs to help financial institutions introduce new products and services for their accountholders. Many also look to their primary technology provider, such as Fiserv, to help curate fintech partnerships and integrate them directly into the banking technology stack. That integration into back-end technology means financial institutions can more quickly and easily introduce fintech capabilities to help plug product and service gaps, strengthen brands and deliver tailored services to target audiences.

Delivering their services through existing banking channels helps fintechs gain access to a built-in audience of small businesses and consumers who already have deep, trusting relationships with their primary financial institutions

NYDIG's partnership with Fiserv streamlines the process for banks and credit unions to enable access to bitcoin. The fintech collaboration with NYDIG enables accountholders to buy, sell and hold bitcoin through their bank accounts, which decreases the risk of disintermediation of financial institutions, providing them with a way to appeal to people looking to invest in digital assets.

What's in it for fintechs? Delivering their services through existing banking channels helps fintechs gain access to a built-in audience of small businesses and consumers who already have deep, trusting relationships with their primary financial institutions. And when fintechs partner with a technology provider such as Fiserv, that built-in audience is multiplied many times over.

As the pace of digital engagement accelerates, the competitive landscape for financial institutions has become especially turbulent. Fiserv is opening our tech stack to help banks and credit unions quickly deliver new, differentiated experiences created by fintechs, stay relevant and continue to provide important support to their communities.

During the pandemic, Fiserv partnered with StreetShares to deliver a more streamlined Paycheck Protection Program (PPP) application and forgiveness process. That fintech partnership helped our financial institution clients earn revenue at a critical time, while ensuring their largest depositors had access to capital to survive. We've extended our relationship with StreetShares to help financial institutions enable more robust small-business lending and credit capabilities.

Realizing the Benefits of Collaboration

Dedicating appropriate resources, time and effort to due diligence and maintaining collaborative relationships is essential for financial institutions that choose to partner directly with fintechs. Fiserv carefully conducts due diligence reviews for the fintechs we partner with, shouldering some of that burden for our clients. That makes it possible for financial institutions to easily and cost-effectively pursue and work with multiple fintechs.

Competition for the next generation of consumers is at the heart of why we are opening our tech stack to fintechs.

The work we're doing with FutureFuel.io, a fintech committed to crushing student debt, offers another example of the benefits of opening our tech stack. Integrating FutureFuel.io into the Fiserv digital experience helps financial institutions quickly deliver FutureFuel.io's unique services to families who struggle with student debt.

In addition to freeing up cash flow for customers, FutureFuel.io's primary focus is to drive growth for the financial institutions they serve. It also helps protect accounts from disintermediation from third parties intent on capturing the entire deposit relationships from primary financial institutions. Competition for the next generation of consumers is at the heart of why we are opening our tech stack to fintechs such as FutureFuel.io, Streetshares and NYDIG.

Transformative Changes Ahead

Financial institutions are embracing fintechs in unprecedented ways. Those relationships will be critical in helping banks and credit unions quickly deliver capabilities to their markets, unlock new revenue streams, manage efficiency ratios, and most importantly, continue to support their communities.

Fiserv is in a unique position to help banks and credit unions meet consumers' high expectations for innovative, differentiated digital experiences, including those of the next generation. By connecting financial institutions and fintechs, not only are we transforming the way innovations make their way to market, but we're also changing the way people interact with financial services.