Mobile and Digital Payments Continue Upswing

The way people pay continues to evolve. Still, many people aren't aware of the payment options available to them, especially through their financial institutions. They want multiple, easy bill pay options, from paying by credit and debit to autopay. And while most can pay their bills, many consumers face difficult financial choices.

Part of our Expectations & Experiences research, the data from this survey was collected in the fourth quarter of 2020, a time when many people remained affected by COVID-19.

Times are tough for many people

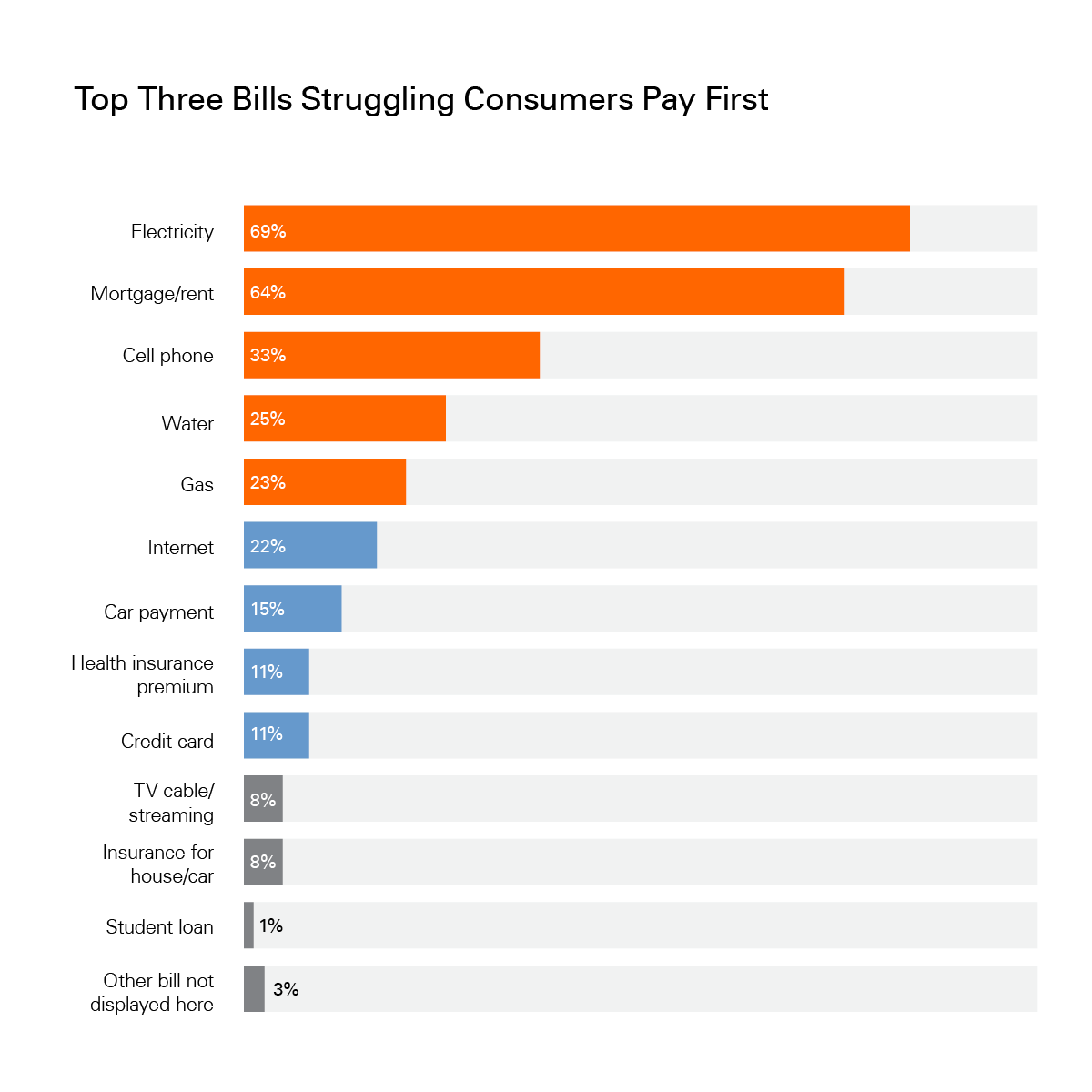

The majority of consumers has enough money to pay all of their bills each month, but many are struggling to make ends meet. That's especially true for Gen Z and millennials. And when consumers have to choose, they prioritize their electricity, mortgage or rent and cell phone.

Survey questions to all respondents: Which one of the following best describes your bill payment experience in the past 30 days? / If you could only afford to pay three bills next month, which would you choose to pay? Select up to 3 responses below.

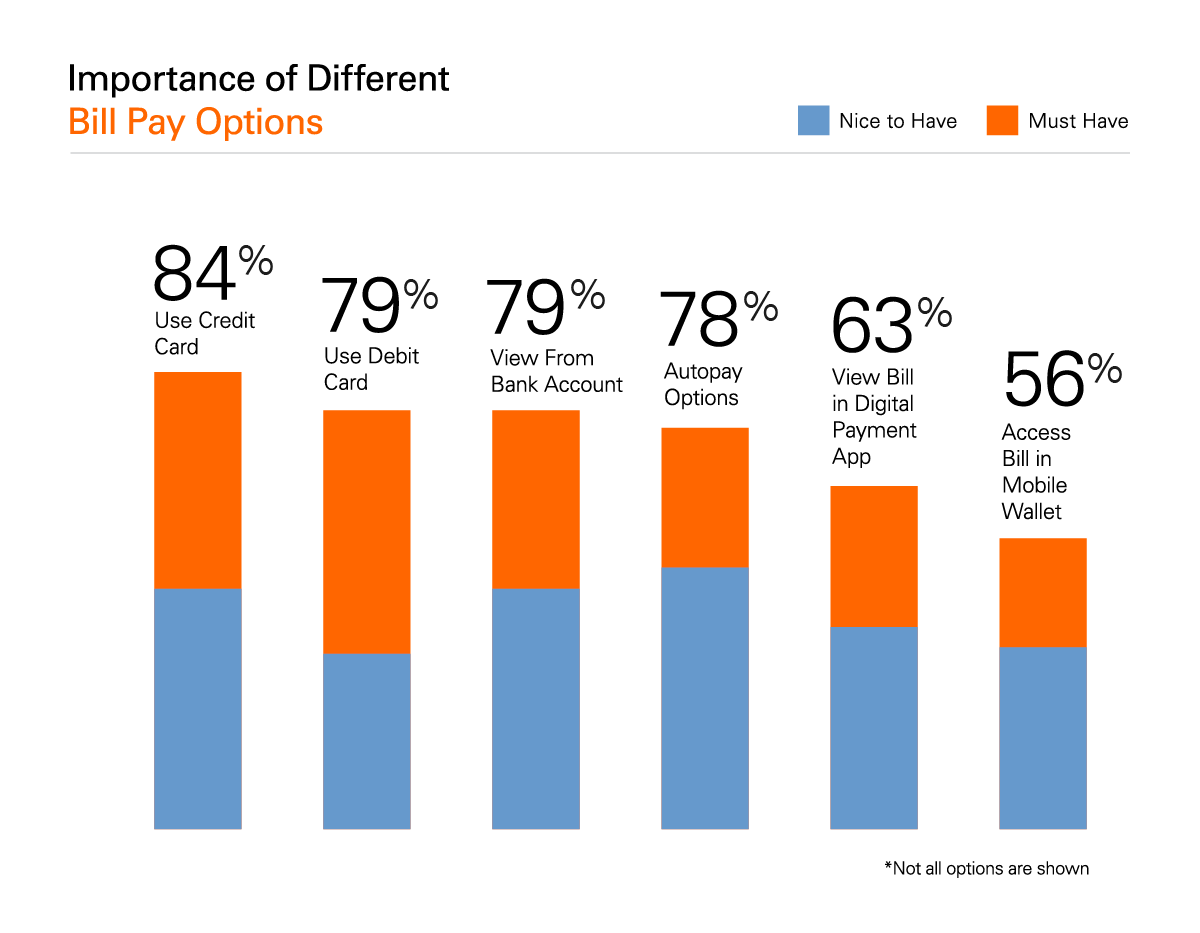

When paying bills, consumers like options

Options to pay bills with credit or debit cards rank high on consumers "nice to have" and "must have" lists. Younger consumers have higher expectations across the board with significant majorities of millennial and Gen Z consumers saying debit cards (94 percent), mobile wallets (82 percent) and digital payment apps (83 percent) are "must have" or "nice to have."

Survey question to all respondents: Below is a list of possible company offerings related to how their customers can pay their bills. How important, if at all, is it that a company offer each of the following?

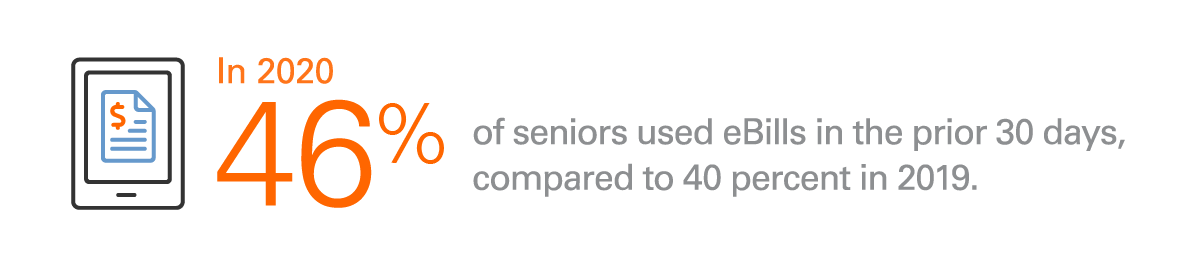

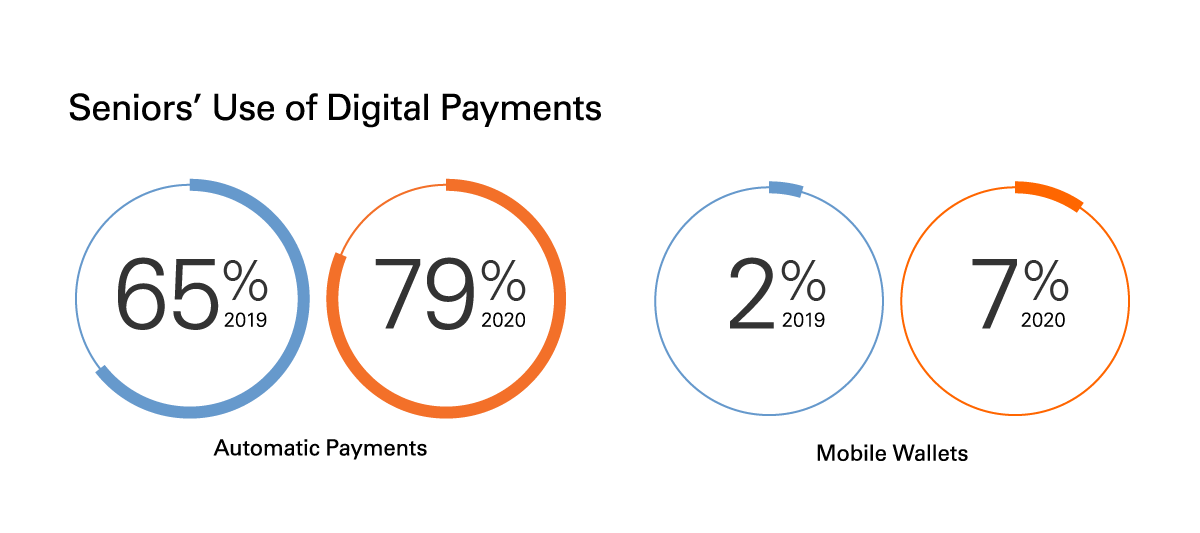

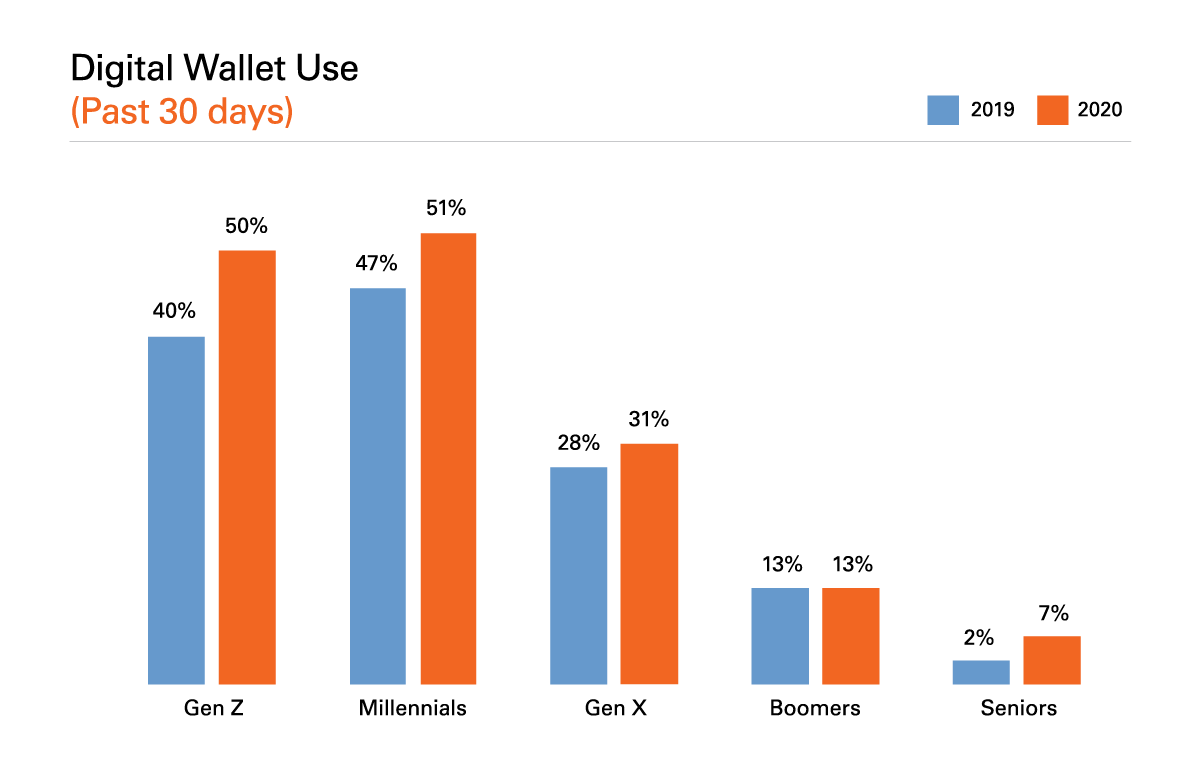

Older consumers look to new types of payments

Whether it's due to more time spent at home in 2020 or just growing comfort with digital options, seniors seem to be stepping up their use of digital bill pay options. The survey found directional increases in everything from digital wallet and eBill use to automatic payments.

Survey question to all respondents: In the past 30 days, approximately how many times have you or your household used the following?

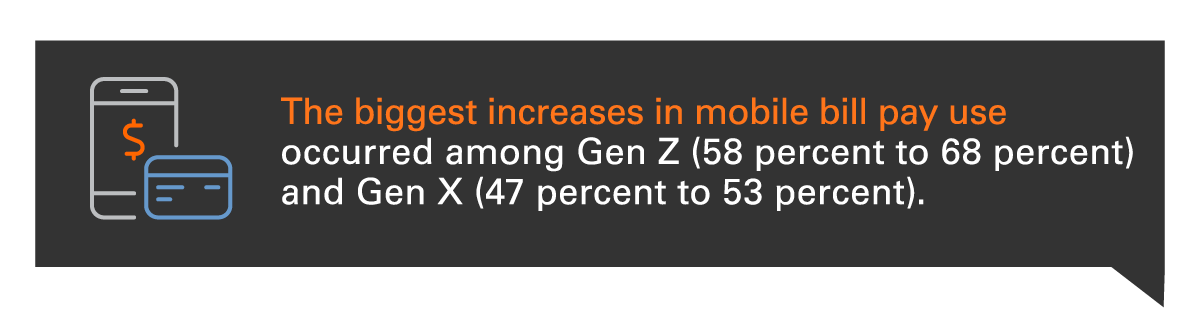

Use of mobile payments methods is on the rise

For payments, automation and mobile options continue to play increasingly important roles in people's lives. Mobile bill pay use in the past 30 days grew from 40 percent in 2019 to 45 percent in 2020. Digital wallets also saw increases across all generations except boomers, while more than one quarter (28 percent) switched at least one bill to be completely paperless.

Survey question to all respondents: In the past 30 days, approximately how many times have you or your household used the following?

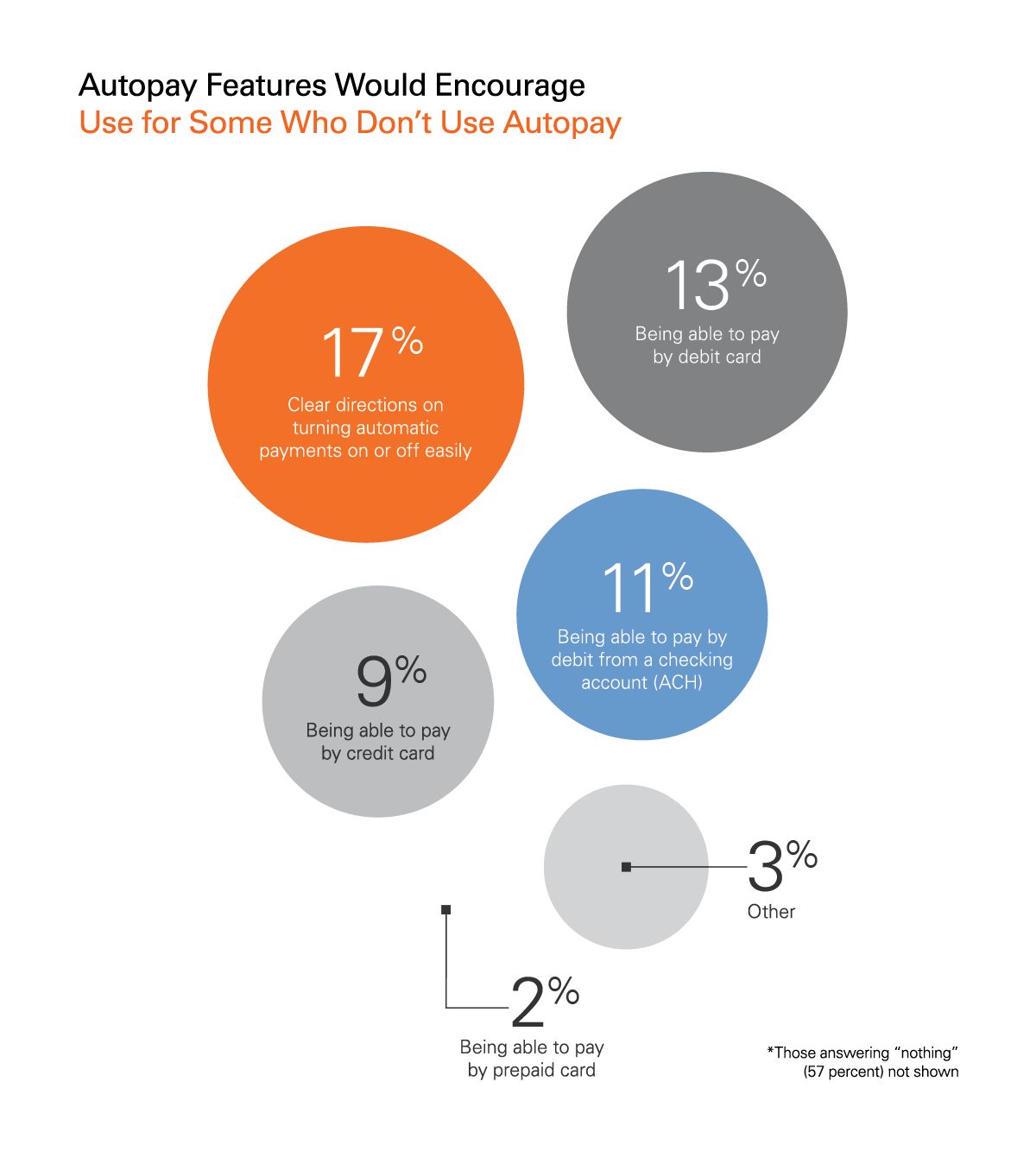

Autopay use holds steady, but some nonusers could be swayed

Recent use of automatic or recurring payments (in the 30 days prior to the survey) has remained steady across generations, with the largest directional increase among seniors. Some who don't use the service say certain features, such as credit, debit and ACH payments, would make them more likely to sign up. However, those payment options are typically available, suggesting consumer education could be warranted.

Survey questions to those who do not use automatic payments: Which of the following, if any, would make you more likely to sign up for automatic/recurring payments? / Do you currently have any of your bills set up to be auto-paid?

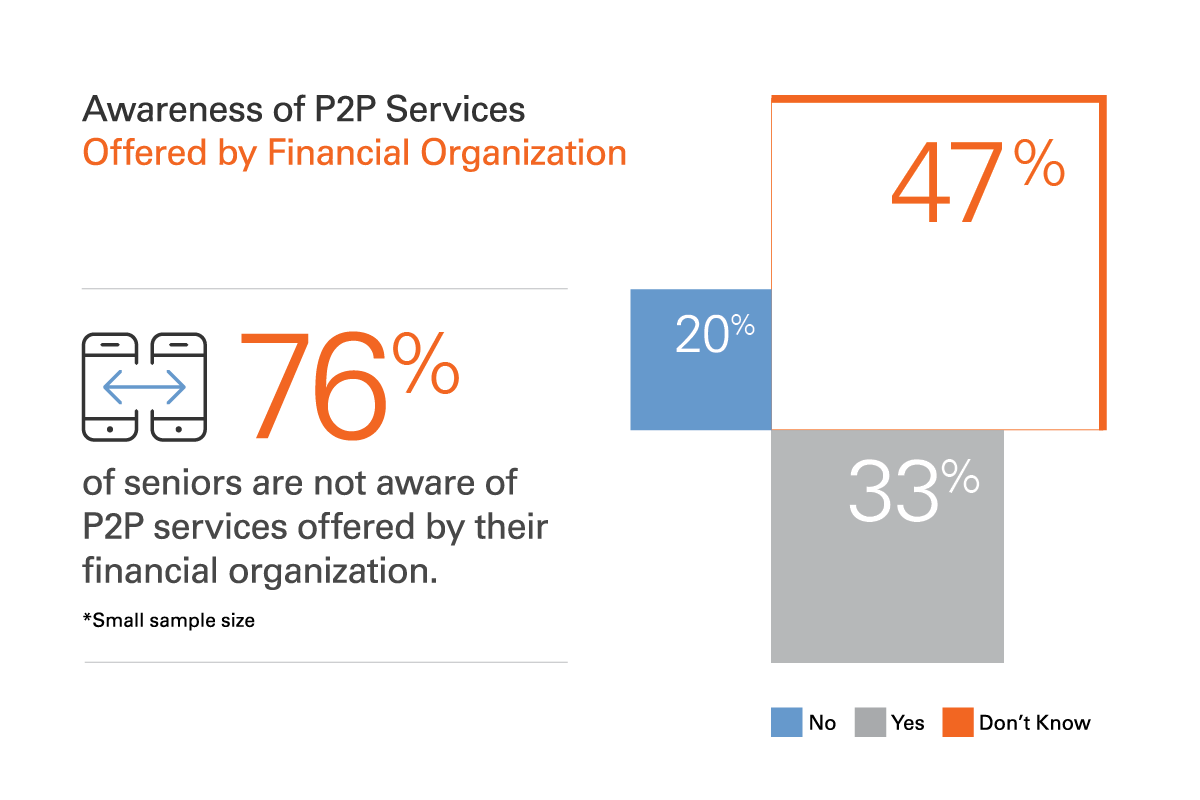

P2P payment use is high, but awareness gaps remain

P2P payments are now the norm, with 79 percent of consumers saying they've used the service through their financial organization or a nonfinancial company. But nearly half of consumers say they don't know if their financial organization offers P2P payments.

Survey questions to all respondents: Does your primary financial organization allow you to send money to another person if you don’t know where they bank? That is, can you send money to another person using their email address or phone number? / Which of the following services, if any, have you used to transfer funds or pay another person or group in the past year?

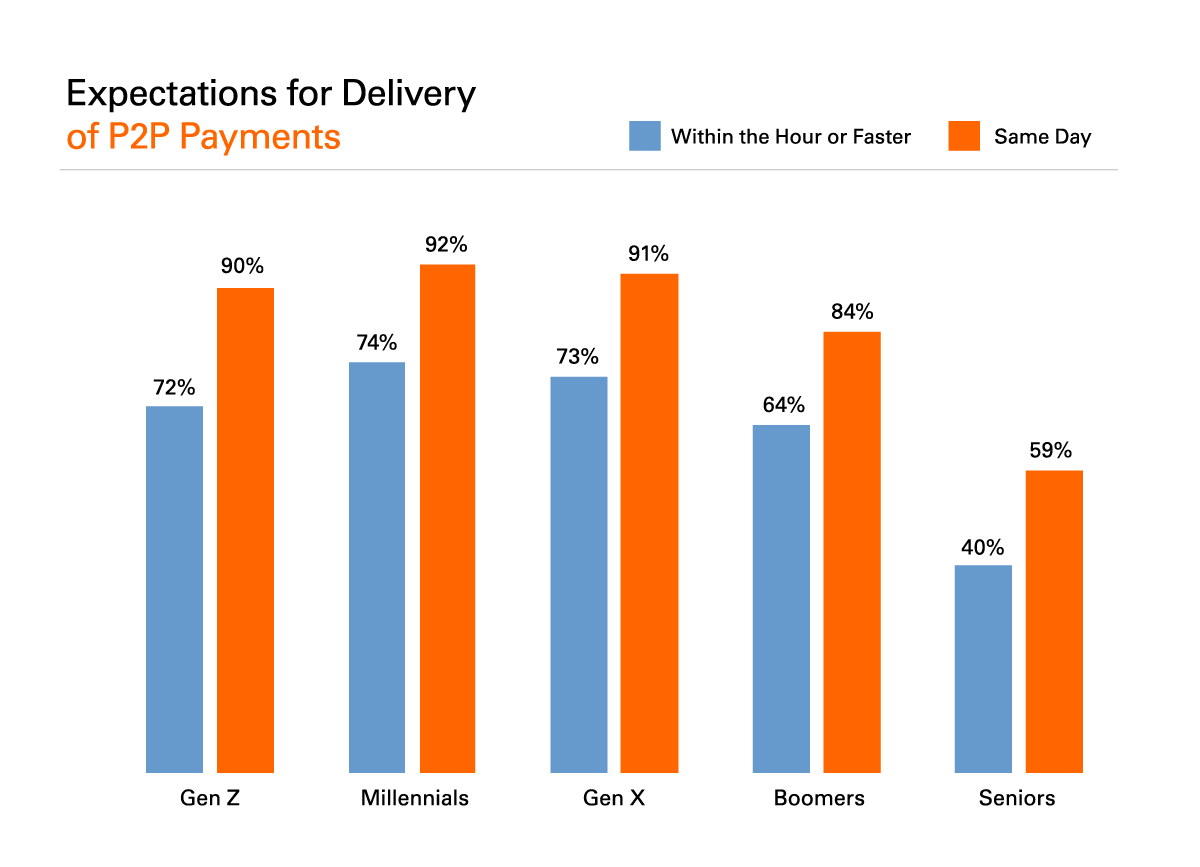

Most expect P2P payments to be fast

Among those who've used P2P payment services, 70 percent expect funds to be received within the hour and 87 percent expect same-day delivery. Among seniors, 23 percent say payment is expected the next day or later, compared to only 9 percent overall.

Survey question to all respondents: When you use a P2P (person to person) service to send money, how quickly do you expect the payment to be received by the other person?

Highlights of the key findings are available for download.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.