2020 Expectations & Experiences:

Consumer Finances During COVID-19

Money Movement in a Changing World

The world has changed and the way people manage money has changed right along with it. Mobile deposits and contactless payments are up, cash is down. People are worried about their finances. And there's a good chance many will return to the branch soon.

This survey was conducted in May 2020 – after the COVID-19 outbreak and the U.S. government's declaration of a national emergency, and before social distancing requirements and business closures had been lifted in many places. It takes a look at the pandemic’s impact on consumers' financial situations along with how they spend, move and manage money in changing times.

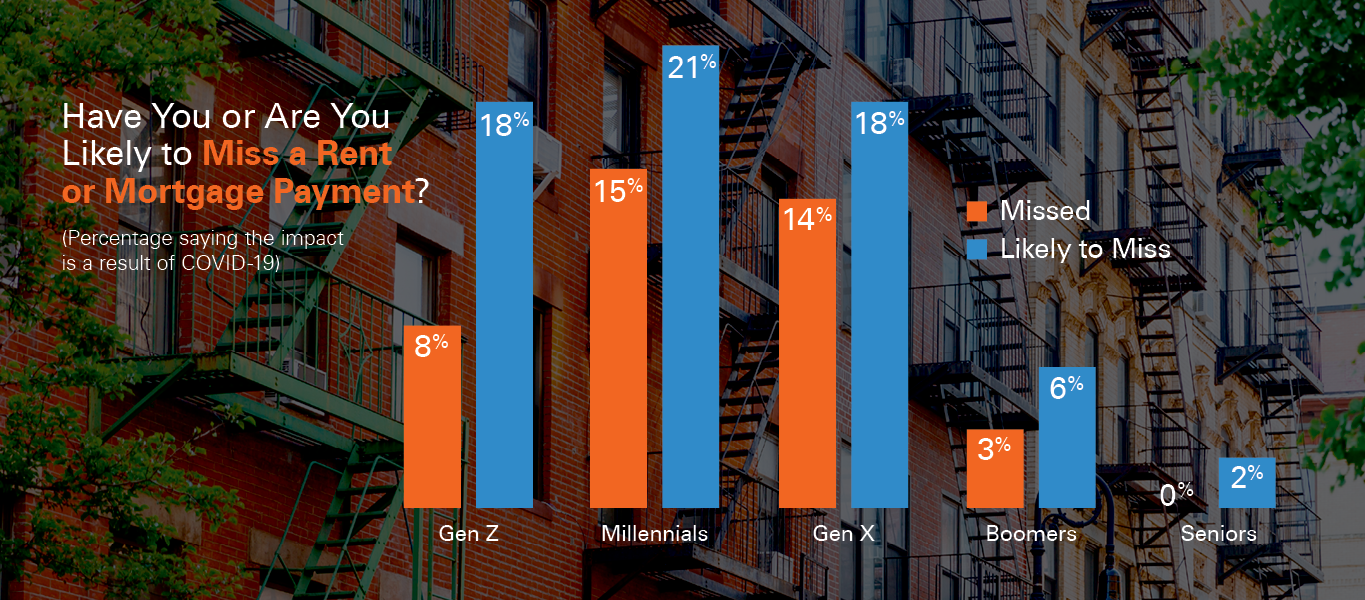

The pandemic has people worried about money

Approximately 70 percent of consumers say they are concerned about the impact of the pandemic on their finances. In the near-term, younger consumers are far more likely to have missed a bill or rent/mortgage payment than older consumers.

Survey questions to all respondents: As a result of the coronavirus (COVID-19) pandemic, have you or your household been impacted in any of the following ways? (Choice of 11 response options) / How concerned are you about the possible impact of the coronavirus (COVID-19) pandemic on the following?

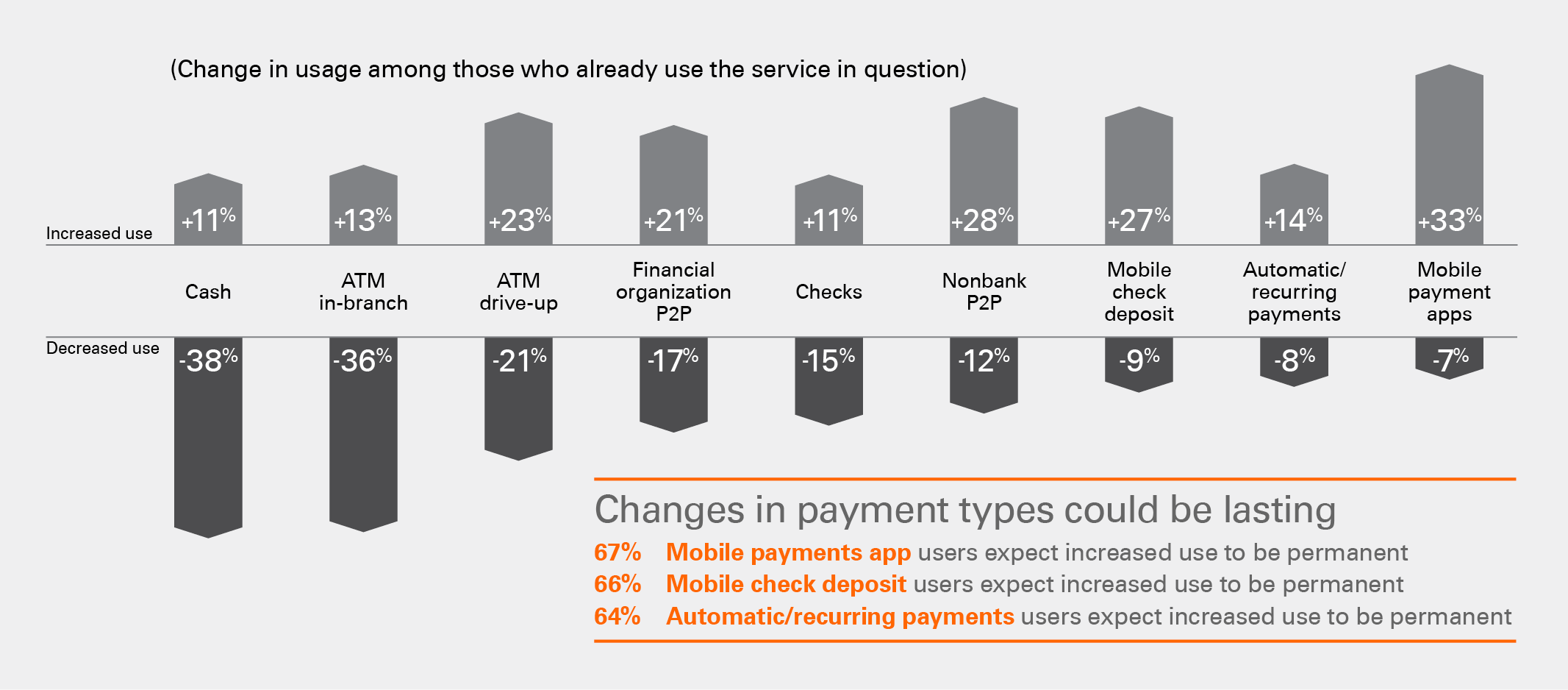

The pandemic has changed payments – possibly for good

More than one in four consumers (26 percent) say they've changed payment methods as a result of the pandemic. Even more have increased use of digital options while decreasing physical payments and cash usage.

Survey question to all respondents: Have you changed your usage of any of the following since the coronavirus (COVID-19) pandemic? / Survey question to those who have increased the activity: For each of the following activities that you say have increased since the coronavirus pandemic, do you think this is a temporary increase or something you will maintain once normal activities have resumed in your life?

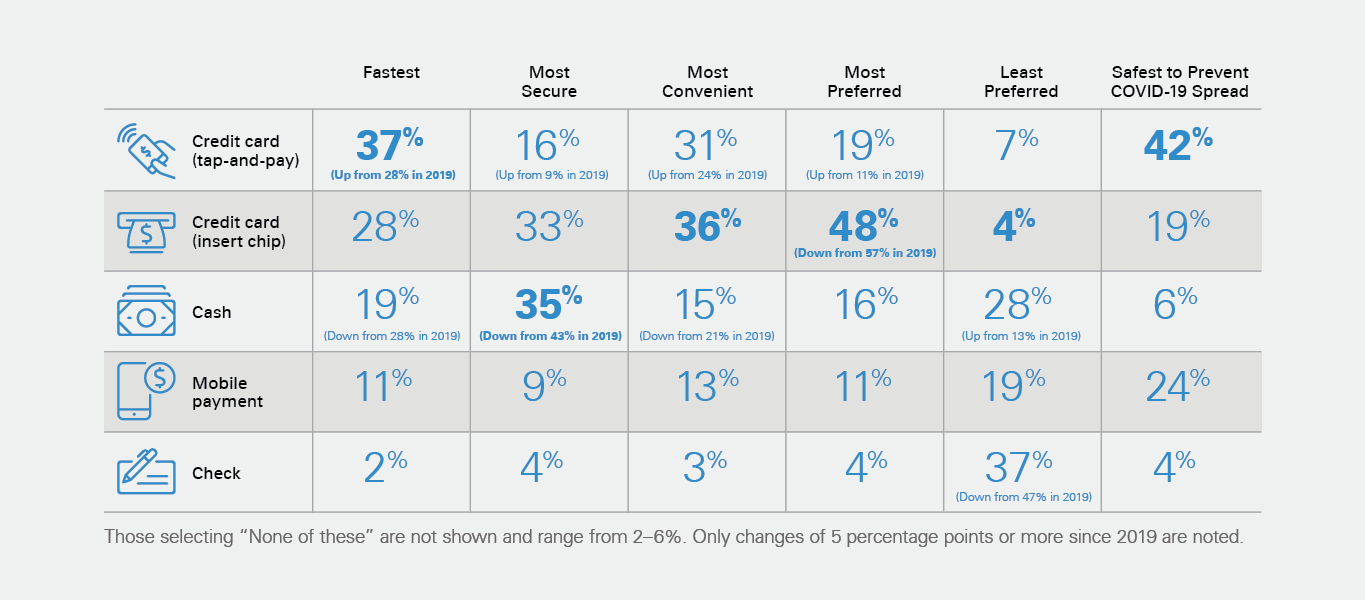

Contactless payments are gaining ground

Use of tap-and-pay cards was trending upward even before the pandemic. Now, the method is perceived to be the fastest, as well as the safest, to prevent the spread of COVID-19. Meanwhile, mobile payments rank second on the safety attribute.

Survey question to those with a card with tap and pay functionality: Thinking only of the way you have paid for items in-person in the past two months, which of the following best describes your usage of the "insert" vs. the "tap and pay" functions of your credit card?

Attitudes toward various forms of payment

Survey question to all respondents: For each of the methods below, please indicate which payment method you believe is the fastest, most secure, most convenient to use, most preferred and least preferred. If you don't have experience using a particular method, select a response based on what you may have seen or heard about it.

Demand for branch safety accommodations is high

While a slight majority of consumers (54 percent) expect to visit a branch soon after opening, 46 percent say it will take 2–3 months or longer. Understanding what will make people feel safe is critical. Once it opens, more people expect to go to their financial organization's branch within 30 days than anywhere else we asked about. Only one in ten say it will be more than six months before they return.

Survey question to all respondents: How long will it take you to do each of the following, once they open? / Survey question to those who visited a branch in the past year: Which of the following, if any, will make you feel safe to enter a bank/credit union branch again?

Highlights of the key findings are available for download.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.

2020 Expectations & Experiences: Channels and New Entrants

Necessity and convenience are driving the ways people manage their finances, from digital payments to voice banking. Our Expectations & Experiences consumer trends survey shows people are ready for new ways to manage money.

2020 Expectations & Experiences: Consumer Payments

Consumers want seamless, on-demand financial services experiences – and more people than ever are turning to digital payments options to get them. According to the Expectations & Experiences consumer trends survey from Fiserv, the drive to digital is showing no signs of slowing down.