No Card? No Cash? No Problem. Accessing Cash at the ATM Without a Card

No Card? No Cash? No Problem. Accessing Cash at the ATM Without a Card

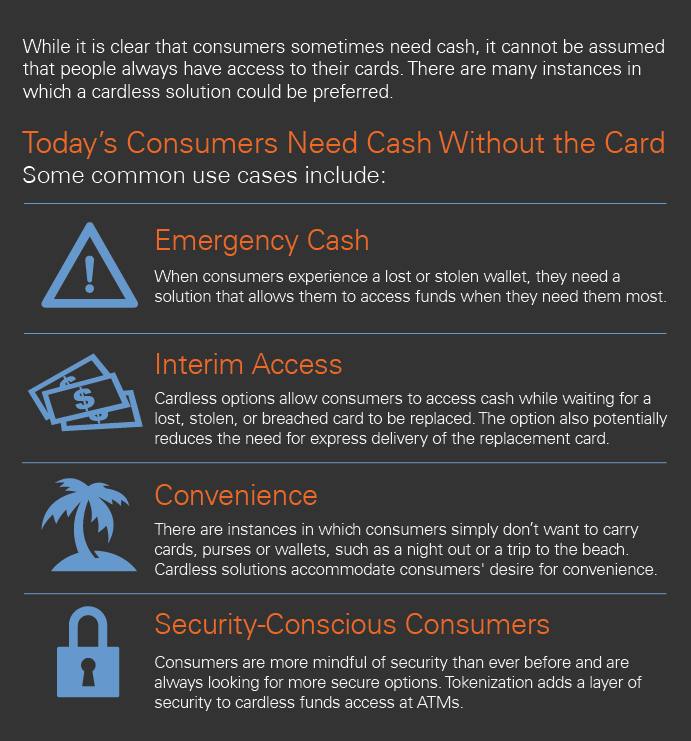

Life moves fast. People rush out the door, forgetting their cash and cards; they leave a purse behind in a restaurant; their wallet is stolen while they're out of town. Even in such circumstances, consumers expect access to their money – access to cash – anytime, anywhere.

Your financial institution can now provide simple, convenient and secure access to cash at an ATM, even when a debit card isn't available. A few of the largest U.S. financial institutions have introduced customized options for cash without cards. Now, financial institutions of all sizes can provide the same capability.

Wondering where to start? Look for a solution that features these core components:

Ease of Implementation – Avoid solutions that require development of a customized and potentially costly solution.

Nationwide Access – Shy away from solutions that are tethered to your network of ATMs. Consumers will undoubtedly need access to cash while away from your service area.

Ultra-Secure – A solution can and should be tokenized to help eliminate the risk of skimming, shoulder surfing and fraud associated with physical card use. You should also consider setting limits on transaction value, frequency and the length of time an access code, such as a token, can be used.

Designed to Evolve – Look for a solution that is adaptable and built to enable future integration into trusted and widely used channels such as mobile platforms and person-to-person payments.

Brand Awareness – A solution that leverages a recognized and trusted consumer brand can provide a level of consumer confidence that transactions will be conducted easily and securely.